Realizing Universal Basic Income

Universal Basic Income is a viable alternative to subsidies. But it has never been implemented at scale because of socioeconomic and political ideologies.

This is the social experiment that will defeat poverty.

A (somewhat) Simple Idea

Universal Basic Income isn’t a new idea at all and was first proposed in the 16th century as a measure to prevent thievery instead of the death penalty. Its current avatar was developed in the 19th and 20th century where it was floated a few times as a “social dividend” or “state bonus”.

Universal Basic Income ≃ A Salary for Every Citizen

Hypothesis

Every single citizen or resident in a nation should regularly receive a fixed unconditional amount of money from the government in addition to any external income they generate.

Although Universal Basic Income seems like a common sense alternative to subsidies, it has never been implemented at scale because of socioeconomic and political ideologies. However, the emergence of AI and automation has reversed its position from a socialist utopian dream to a viable opportunity in a capitalist world. In fact, India has proposed to replace its messy social welfare system with a simple monthly stipend in the next few years.

The End of Poverty

Extreme poverty is crippling because it is the direct precursor to poor health and eventually early death.

Poverty deserves to be extinct and I believe Universal Basic Income will be its silver bullet. However, I also know that it won’t work unless we tweak its mechanisms and commit ourselves to a decade of experimentation. Poverty perpetuates inequality and indifference. And so as we attempt to realize the first Global Goal these are the ten suggestions we must adopt to ensure the end of poverty by 2030.

1. Universal Basic Income shouldn’t be universal

The cost of providing Universal Basic Income to everyone equally would itself economically cripple most governments. It would account for anywhere between 5-10% of national GDP and this alone should dictate selectivity in application. Furthermore, implementing it universally would only institutionalize leakages from the inefficient social welfare system it hopes to replace. The scope of Universal Basic Income should be limited instead to focus on breaking down economic barriers and stimulating economic mobility among the poorest.

2. Define purpose as poverty alleviation

Universal Basic Income should solely exist to lift the remaining millions out of poverty. Its adoption is a complementary approach to the default social welfare system and should not be viewed as a solution to other pressing issues such as youth unemployment and falling wages. Unlike other solutions the release of a regular monthly payment would instantly guarantee a decline in poverty levels and accelerate the 2030 timeline. In addition to this, it would provide sufficient time for governments to test if the scheme provides enough of a social safety net for beneficiaries to permanently escape poverty through their own efforts.

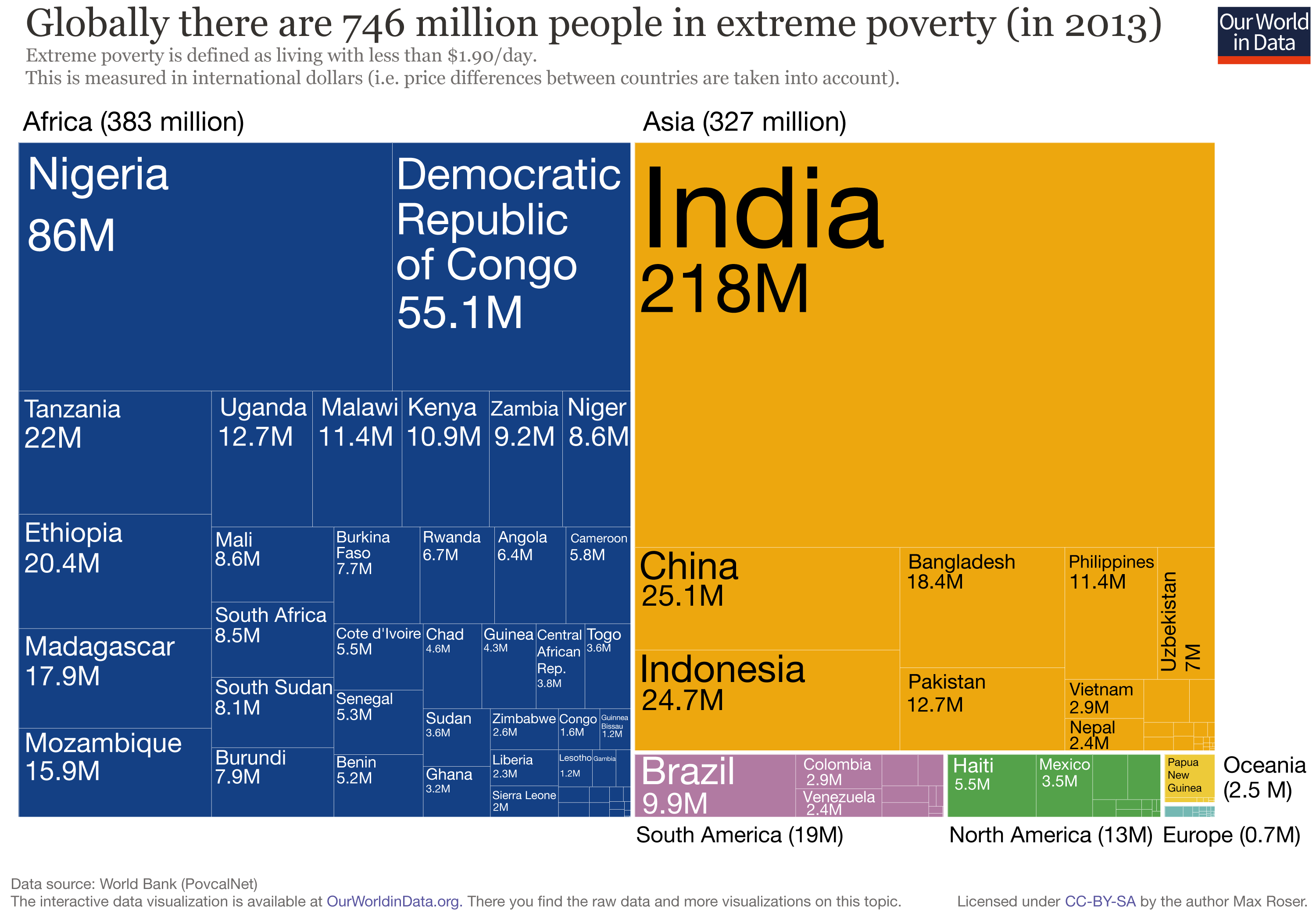

3. Focus on the base of the pyramid

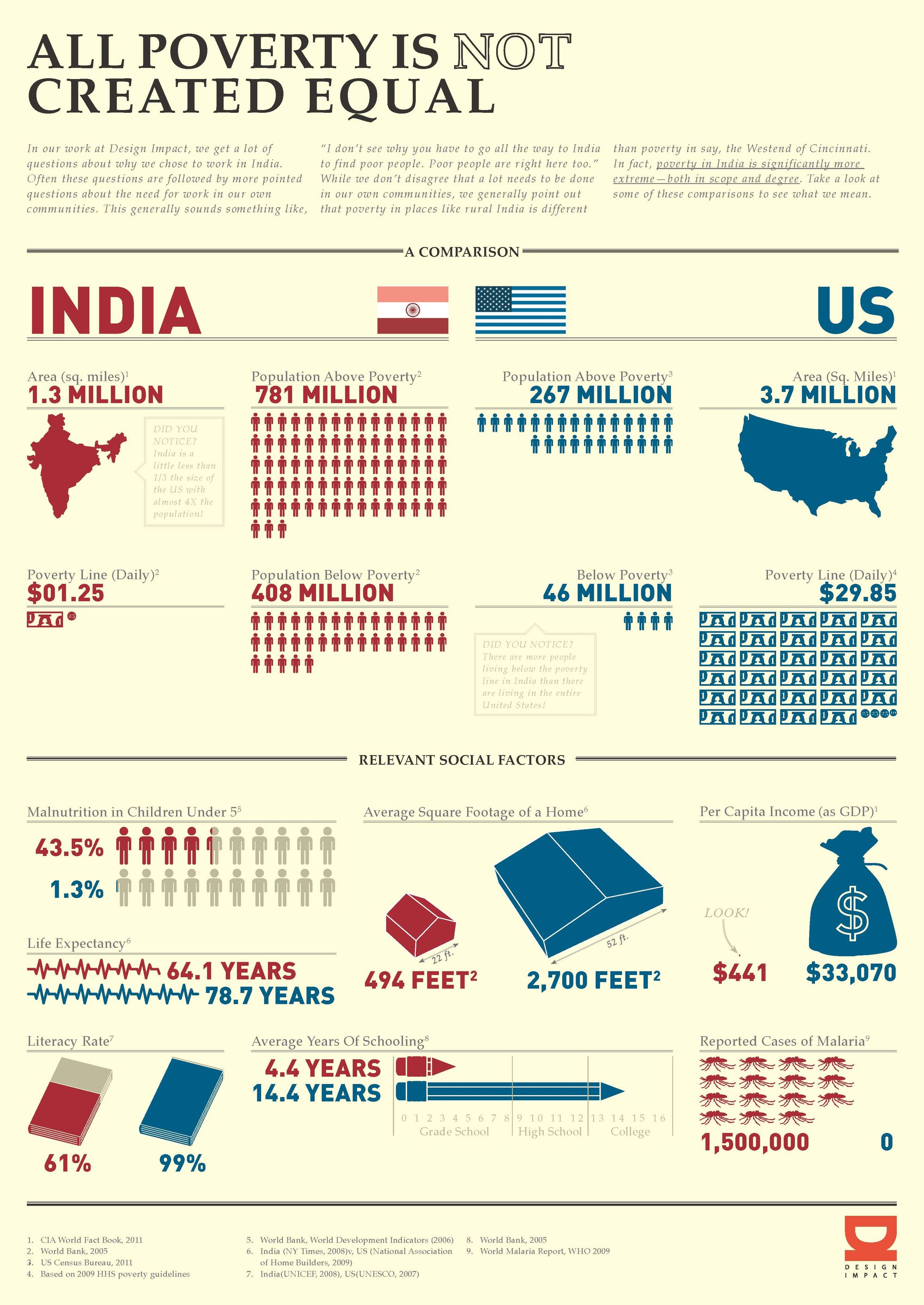

Universal Basic Income systems become economically viable if they only serve the marginalized sections of society because their impact is focused on 20-40% of the population. This target group would be defined using net daily income levels and in the case of India would number approximately 290 million people since 21.9% of the population survives on less than $1.90 per day. This may be a significant group size but it’s far more feasible to serve through a Basic Income program than traditional subsidies.

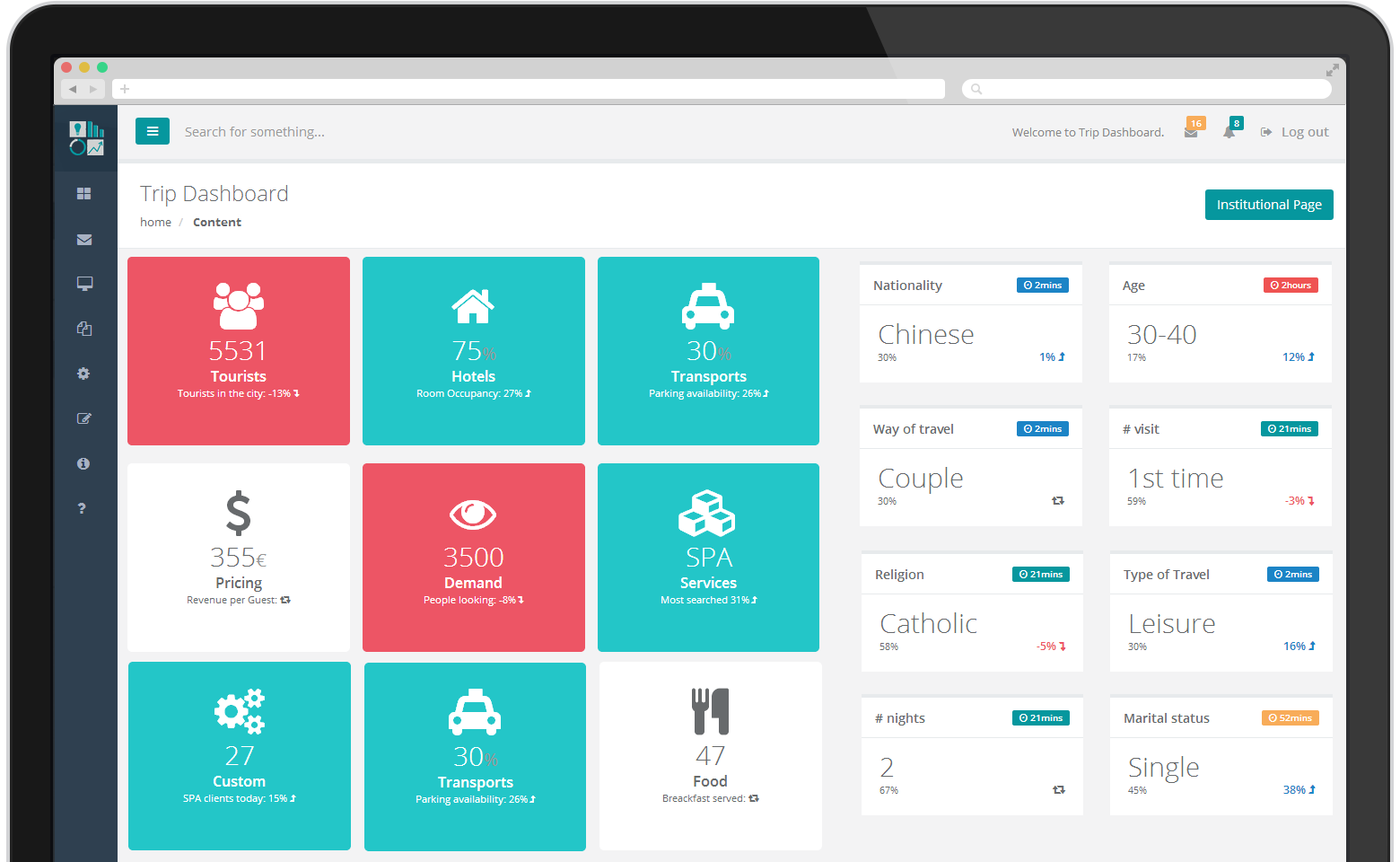

4. Define a real time target

It should be obvious to everyone that poverty and its impact differs wildly from nation to nation, and thus it’s essential that all Universal Basic Income schemes release a real time public target that is tracked using a dashboard of metrics.

Global Targets

Phase 1: 100% coverage of target group in 5 years.

Phase 2: 80% permanent migration from Universal Basic Income in 10 years.

These global targets would be measured across a set of variables specifically -

Coverage indicates the government’s ability to reach and successfully enroll the target demographic while permanent migration represents a positive change in finances for individuals owing to economic mobility. This would result in a net decrease in spending for the Universal Basic Income scheme over time since at any given moment only a section of the populace would need to be covered.

5. Link money to quality of life

Universal Basic Income needs to be linked to a respectable quality of life which should be considered in addition to the Consumer Price Index as we attempt to determine the amount that will be regularly paid to individuals. And so, this sum shouldn’t be limited to an inflation pegged poverty line but instead rely on either a living wage or a multiple of the poverty line ranging between 1.5 and 2. This would ensure that the 8+1 Dimensions of Quality of Life are at the core of every poverty related discussion and become the preferred policy framework for economic mobility.

6. Digital distribution of money

All social welfare systems are leaky by design but we must not allow this issue to be migrated to Universal Basic Income. Thus all stipends must be distributed via blockchain or any other public ledger system directly to special bank accounts. These receipts could then be individually authenticated using a digital biometric system such as India’s Aadhaar to ensure only the right person has access.

7. Track all spending from public stipend

It is essential to track the spending habits of the target population receiving Universal Basic Income benefits since this data would be a valuable asset in shaping other complementary policies. The most secure and efficient way of doing this would be mandating all payments from the stipend bank account to be made via electronic means (card, wallet, etc.). Over time this would inform governments on which subsidies are proving to be ineffective across categories and enable data led iteration based on user demand.

8. Empower women to escape poverty

Women are the gatekeepers of prosperity and as governments explore the implementation of Universal Basic Income programs in a phased manner it would be ideal to extend it to them before men. This would limit initial roll out to 40-50% of the target group and allow policy iteration to occur within a safe environment. This isn’t unusual since social impact organizations such as the Grameen Bank, a global leader in microfinance, have made women the central actors of their strategy and social mission, and received tremendous success.

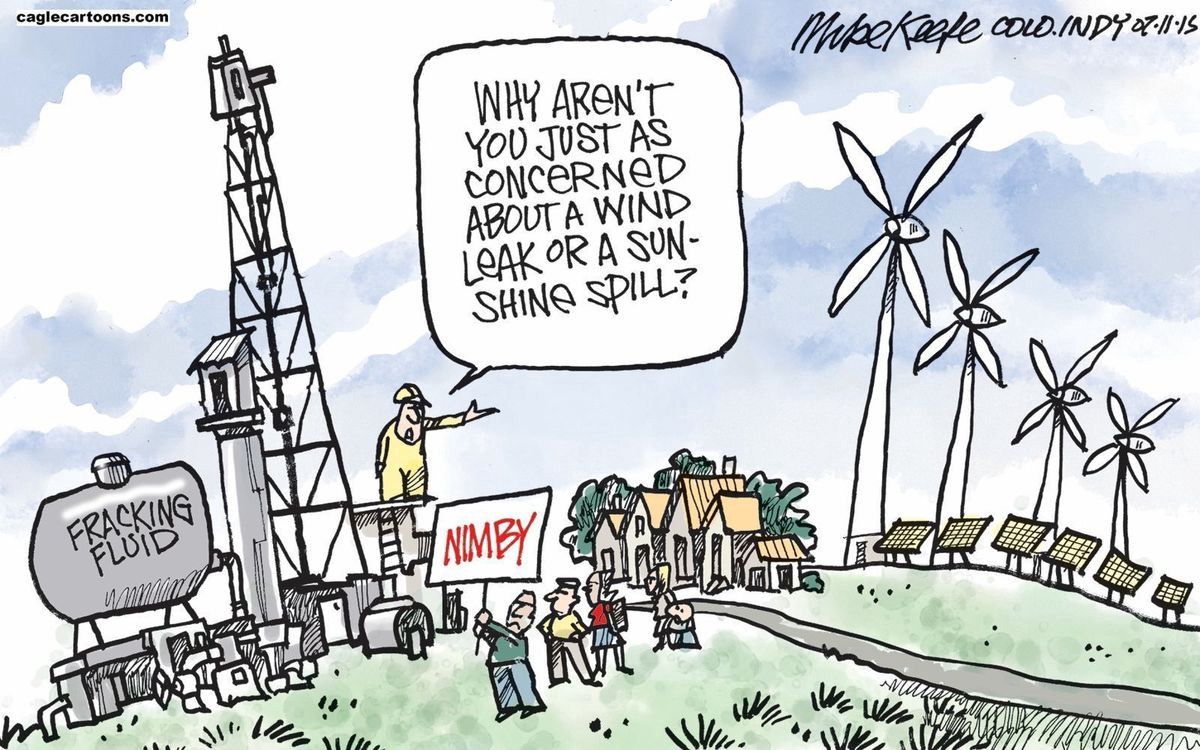

9. Fund by sunset of subsidies

Not all subsidies are created equal. And unfortunately the support an industry or segment receives is not related to its potential for disruption or efficiency. It often boils down to lobbying and politics. This is exactly why Universal Basic Income needs to be introduced to rebalance the power dynamic in governance. In fact, the bulk of it (80%) should be funded by retiring alternative social welfare schemes specifically those focused on fossil fuels, tobacco, etc. This move will allow Universal Basic Income to be implemented with an additional spend of 1-2% GDP making it entirely feasible. And if necessary an additional charge such as India’s 2% CSR Tax could be applied to bolster the public coffers.

10. Wean off Universal Basic Income

Universal Basic Income is not a permanent emolument unless it’s implemented within the framework of the post jobs economy as will be the case in developed economies such as the US or Switzerland. However, developing countries should view it as direct economic support offered to its most marginalized sections so as to allow economic mobility to take root. In this context, a framework to wean recipients off of their Universal Basic Income stipends becomes necessary. The simplest version of such a policy would be to provide benefits for 2 consecutive years before reevaluating their eligibility, based on income level and stability, for an extension of the same duration. This would allow the program to serve more people within the same budget due to churn and permanently provide economic security to the most vulnerable sections of the target group such as the elderly and women. It would also give enough of a runway for governments to ramp up their budgets for the scheme to match their population growth.