The Regulator - A Balancing Act

An exploration into the real role of a regulator in today’s world. Regulators make rules. People bend rules. An ideal regulatory agency provides structure to an industry or section of society where the lack of it would prove detrimental to its long-term development.

An exploration into the real role of a regulator in today’s world.

Regulators make rules.

An ideal regulatory agency functions in the area of administrative law and exists solely to provide structure to an industry or section of society where the lack of it would prove detrimental to its long-term development. A regulator achieves this outcome by conceiving, codifying as well as enforcing rules.

People bend rules.

People usually follow rules but whenever creative, determined individuals encounter processes which stifle innovation, growth or convenience they attempt to bend them. This may not always be the right thing to do but there is no denying the fact that exploiting gray areas often unlocks real value.

RESERVE BANK OF INDIA VS. UBER

It is with this frame of reference that we should try to unravel the incident of the Reserve Bank of India (RBI) taking on Uber.

The RBI issued a circular on August 22, 2014 effectively stating that the convenience Uber was offering to its clients amounted to a violation of the Foreign Exchange Management Act. There may be numerous rationales to justify their stand but a regulator’s primary interests are always to protect the consumer, build trust and spur economic growth. However, it seems to be exactly the opposite in this case.

AN EXERCISE IN TRUST

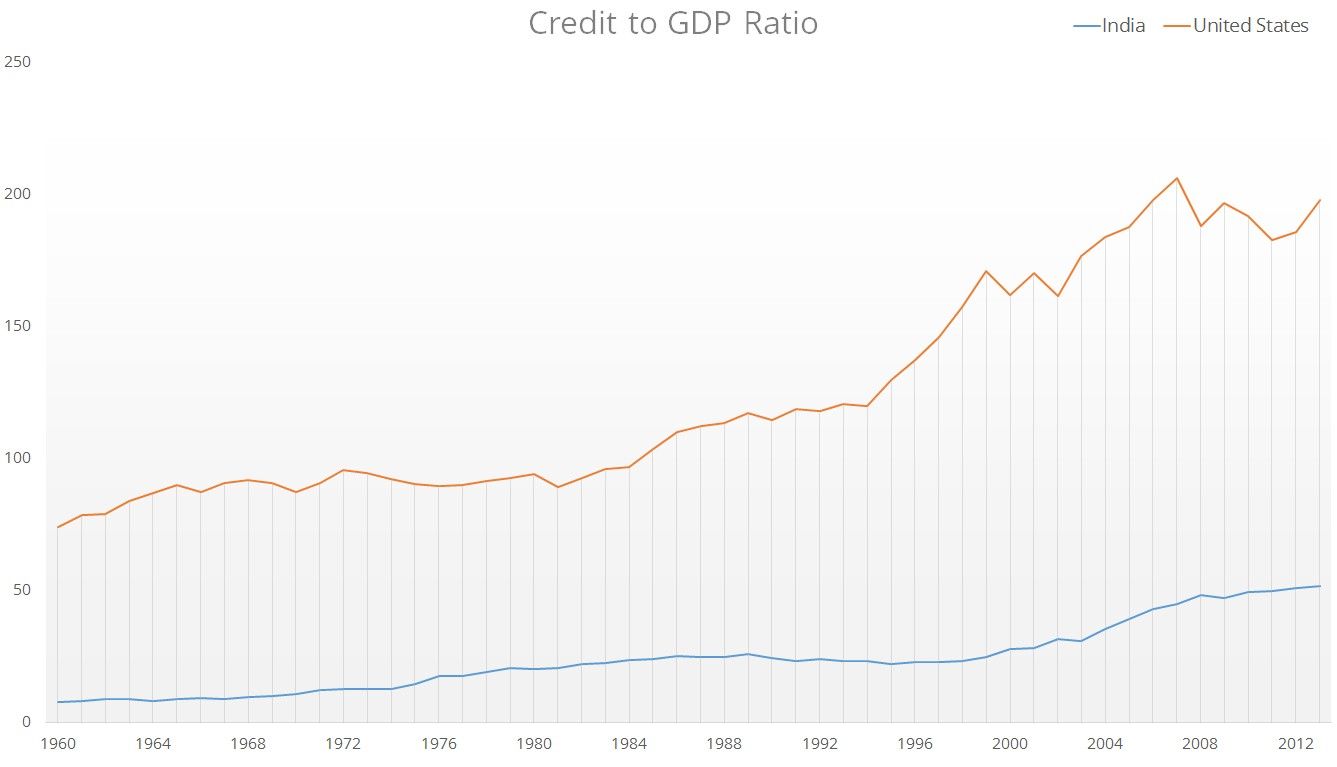

India has always been an under-banked nation and as recently as 2013 its Credit to GDP ratio stood at 51.8% as compared to 198% in the United States of America. Thus, it is understandable that RBI is usually very cautious when it comes to consumer security. However, its choice to address this concern through regulations and structural mechanisms, such as one-time passwords and two-factor authentication, is far from perfect.

The pro regulation model completely derisks insurers and shifts the responsibility to consumers. Furthermore, the complexity of this process weakens macro trends in consumerism and credit liquidity. In contrast, mature economies such as the USA have put the onus on consumer convenience by securing credit purchases via insurance. This pro convenience model has, over the long term, inspired consumer confidence and boosted commerce.

CAPITALISM AND DEMOCRACY

These are the boundaries within which regulators are usually governed although sometimes socialism and monarchy form the alternative.

A regulator never exists in a vacuum and it is precisely for this reason that its actions must account for, if not involve, market led or open innovation. These innovations illuminate the gray areas of its prescribed code and are unique from market forces because they build scalar and modular changes in the economy as compared to diktats or responsive policies.

Uber’s payment model is one such business innovation and has proved to be a strategic barrier for its competitors. It has also allowed Uber to structure a previously cash-only industry in India by cultivating a user base that desires the utmost convenience and accepts risks with a globalized perspective.

Regulators hate alphas.

If all real progress is predicated on innovation then their commercial success is dependent on Alphas. These users are present in each and every ecosystem and exist solely to create demand, facilitate mass adoption and build triggers. Alphas believe in the concept of a flat world and thus harbor very high expectations of their local context. Consequently, they have a high appetite for risk. Regulatory agencies, unfortunately, often fail to share the same world view as Alphas and this leads to conflicts.

Regulators love fights.

A successful market led innovation is an important trigger in an economy because it usually indicates greater maturity in that ecosystem than what the regulator expected. Furthermore, these triggers point to a systemic shift in the functioning of that particular economy which creates redundancy and inspires a classic Fight or Flight Response from the regulator. However, most regulators are hierarchically predisposed to picking fights rather than accepting triggers as bottom-up feedback loops.

A BALANCING ACT

Regulators have never had it easy but this is a trend that will only accelerate in the future. Thus, they must realize that their evergreen strategies may not work in the future because of contextual shifts.

In the past, regulatory agencies had a limited set of choices - Advance and Hold. They would either propose policies or maintain them. However, if regulators wish to thrive in the future then they must aim to strike a balance between authoritarianism and inclusiveness by incorporating a new choice - Retreat. They must learn to view innovation triggers as policy earthquakes and utilize their ability to withdraw and allow self-regulation.